Contents:

The most common and price action secrets example of the Price Action Indicator is “Consolidation” best price action strategy. 7 Winning Strategies for Trading Forex Many traders go around searching for that one perfect trading strategy that works … Here are 4 price action secrets that will change the way you trade. When it comes to trading, a lot of traders focus on finding the perfect indicator.

20 Underrated Shows You Might Have Never Heard of – MovieWeb

20 Underrated Shows You Might Have Never Heard of.

Posted: Sat, 01 Apr 2023 15:00:00 GMT [source]

By combining measured moves with other technical analysis tools and indicators and using a trailing stop-loss order, traders can manage their risk effectively and maximize their profits. Furthermore, being able to identify consolidation can also help traders manage risk. Suppose a trader is already in a position, and the price begins to consolidate.

More seller options (

This suggests that fewer sellers are interested in selling at the resistance level each time. In this case, the resistance level becomes increasingly weaker. Furthermore, just before the breakout occurred, the trend was accelerating upwards as the dotted arrow indicates. Eventually, the price broke through the resistance level and an extended upward trend emerged when no selling interest was left. Depending on where a price action setup occurs, you should interpret it differently. The same pin bar could be bullish or bearish, depending on if they show up at the bottom of a downtrend or top of an uptrend, respectively.

- https://g-markets.net/wp-content/uploads/2021/09/image-sSNfW7vYJ1DcITtE.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-vQW4Fia8IM73qAYt.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

The tools that you use will be things like support and resistance, candlestick patterns, etc. It’s about identifying the current market condition so you can adopt the right price actions trading strategy at the right time. As traders, we can use support and resistance levels to identify potential trade entry and exit points. Even if you see the best price action signal, you can still greatly increase your odds by only taking trades at important and meaningful price levels. Most amateur traders make the mistake of taking price action signals regardless of where they occur and then wonder why their winrate is so low. The Silver price returns sooner and sooner to the same resistance level, as the arrows indicate.

Price action analysis: NZDCHF

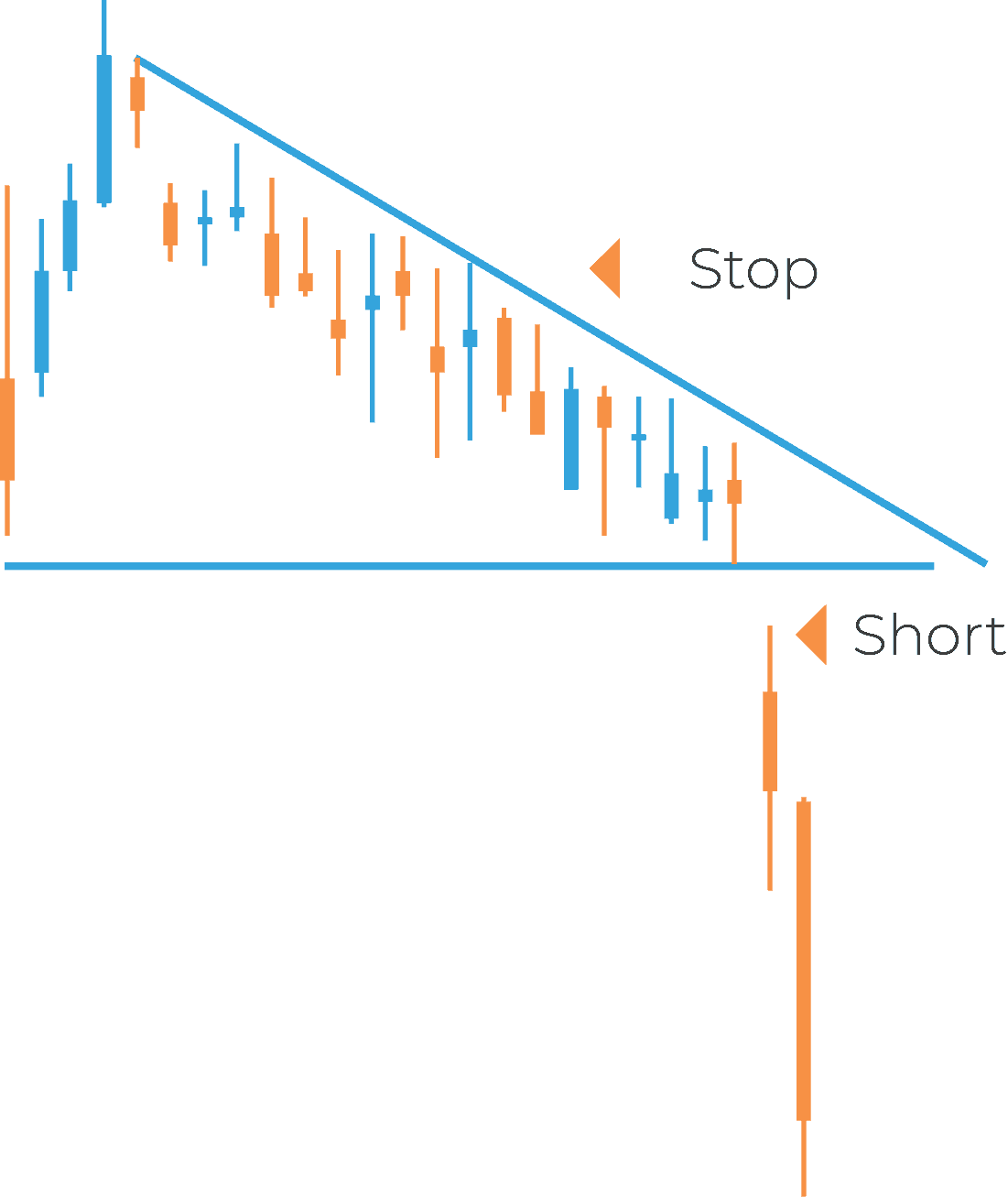

The Law of Charts is a concept developed by trader Joe Ross that helps us identify and understand trends in the market. It’s a simple idea that can be incredibly powerful when used correctly. Traders can get into trouble quickly because it is not always obvious how a trend line can be drawn. If there are uncertainties in the correct application of the trend lines, it is advisable to combine them with horizontal breakouts.

Again, this is where just simpletechnical analysiscould come into play. But if you are a trader, you don’t want to be buying in a downtrend. Knowing where to place an order is just the beginning. Fixed pips stop loss levels are hardly a good approach since the market volatility can change and every trade should be looked at within the context of the recent market history.

They speak about secret trading strategies for day traders, the psychological aspects of trading in the market, and the authors’ personal experiences. In light of this, we have compiled a list of 10 price action trading secrets to consider. They can help you better understand the markets and make more informed trading decisions. This book was actually excellent at teaching price action trading.

And which platform are you using it looks easy unlike what I use the background is black and candlesticks are both green for bullish and bearish. Try to know the function of the indicators and complement it with price action for better results. There are various ways for entry and exits, depending on your trading strategy. As traders we do need to be constantly reminded of these basics as we can all be compulsive at times . Keep up your great service Rayner and thank you again for your invaluable advice. Nice tutorial, I got more knowledge about price action from here.

Multi-candle patterns are more reliable

Another point that marks strong support/resistance zones is the daily open when a day closes and a new one begins. If a resistance zone is formed in a downtrend, wait for the price to hit this zone again and open a short position. If this formation occurs in an uptrend, then enter a buy position at point D, while in a downtrend, open a sell position at point D. Please explain and show much more precise what do mean by price action trading since this topic is very compact for my mind.

Buyers speculate that prices will increase and drive the price up through their trades and/or their buying interest. Sellers bet on falling prices and push the price down with their selling interest. Price action is among the most popular trading concepts. A trader who knows how to use price action the right way can often improve his performance and his way of looking at charts significantly. However, there are still a lot of misunderstandings and half-truths circulating that confuse traders and set them up for failure.

The go-to guide for launching a lucrative career in trading – fully updated for today’s turbulent markets. One of today’s most successful traders, John F. Carter has made his popular guide more relevant and effective than ever. Thank you Rayner T for simplifying price action trading strategies. I have been following your post for some times now, its really an eye opener. Please, can you make a video about trailing stop on mt5. In the daily timeframe, I have no idea what the news is for this market right now, but as a price action trader, I know one thing.

Structuring IP Licenses to Manage Supply Chain Risks in the … – Foley & Lardner LLP

Structuring IP Licenses to Manage Supply Chain Risks in the ….

Posted: Tue, 28 Mar 2023 14:57:41 GMT [source]

You don’t want to be buying in a downtrend unless you are an investor or Warren Buffett. So, these are all possible trading opportunities for you to get long in this advancing stage. If the market retests this trendline, I know it has the confluence of this area of support as well. This means that you won’t think of selling this market.

Price action secrets: You can ignore the news

Thus, do not trade at the first signal when the price breaks the trend line, but only when the price subsequently forms a new low or high as well. One big problem I often see is that traders keep looking for textbook patterns and they then apply their textbook knowledge to the charts. Corrections are short price movements against the prevailing trend direction.

77.93% of retail investor https://g-markets.net/s lose money when trading ᏟᖴᎠs with this provider. This one technique has made me more money over the years than any other. I’ve had several members tell me they’ve doubled and even tripled their profit without having to increase their risk. Going from new user to the next level only takes some reading of different posts. An excellent introduction into what it actually takes to makes money from trading. Some very useful tips for anyone wanting to start out.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

After that, you will discover how to create a Forex trading structure that you must at all times. You will also discover who are the best Forex brokers for both US and non-US traders. Lastly, you will learn how to trade USD-GDP and USD-CAD most efficiently.

When big institutions are done building their positions in a sideways area, they start aggressively buying or selling to make a trend or price movement. That way, if successful, they are always profitable. These big institutions need to set their positions before the big trend because there is little time when the trend forms. To understand the price and candlestick analysis, it helps if you imagine the price movements in financial markets as a battle between the buyers and the sellers.

Here is a close look at their mirrors and smoke machines, the pulleys, cogs, and wheels that create the grand illusion called money. It reads like a detective story – which it really is, but it’s all true. If you are like most traders, you probably overlook or misunderstand mental and emotional obstacles.

I think it will perfect for everyone for learning Forex trading business. In here Financial Markets with a 30 Minutes a Day Routine. I’ve looked at a number of your videos and wanted you to know that they have all been very helpful, easy to understand and have improved my trading. Hi, as you said, when a market is in a range, we need to know when to enter and exit. Do you use a weekly, minute or monthly view to determine the trend?